March is usually a good time for reckoning in the air cargo industry. Any lopsided demand figures from the Chinese Lunar New Year surge are generally smoothed out by the third month of the year, and post-holiday inventory restocking generally begins to ebb as spring arrives.

The March results from the major data analysis organizations, such as IATA and WorldACD, often start to give us a clearer picture of what may lie ahead for the industry.

But, according to the latest interpretation by Cargo Facts (below), the lackluster results from IATA (only a 1.7 percent rise in global demand) and the optimistic yield data from WorldACD (a 16.3 percent rise, in U.S. dollars) for March are neither as gloomy – nor as rosy – as these indicators may lead one to believe.

Two weeks ago, when we looked at the March air freight data from some of the early-reporting major carriers, airports, and handlers, it was clear that, for most of the world, demand growth had dwindled to almost nothing. The exception was three big carriers from the Americas – United, Delta, and LATAM – all of which continued to report double-digit, or almost-double-digit, gains.

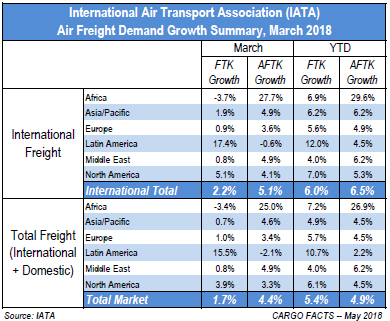

Comprehensive analyses of the worldwide air freight market recently published by IATA and WorldACD confirm our early findings: Overall demand for air freight rose only slightly in March, but the strong economic recovery in Brazil drove 15.5% year-over-year growth in Latin American carriers’ cargo traffic, and also boosted traffic between North and South America, to the benefit of some North American carriers.

According to IATA, total worldwide air freight traffic (measured in freight tonne kilometers flown) increased 1.7% y-o-y in March, led by 2.2% growth in international traffic.

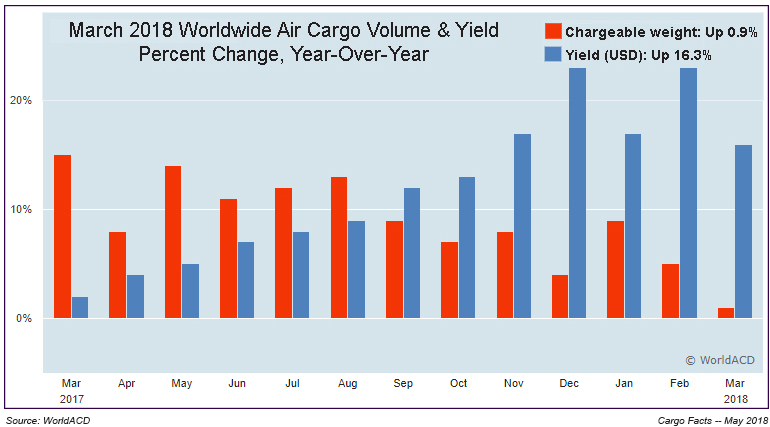

WorldACD looks at volume (in chargeable weight) rather than traffic, and by its calculations, March volume was up 0.9% y-o-y. Either way, one could sum up the month by saying that air freight demand in March 2018 barely increased from March 2017.

WorldACD looks at volume (in chargeable weight) rather than traffic, and by its calculations, March volume was up 0.9% y-o-y. Either way, one could sum up the month by saying that air freight demand in March 2018 barely increased from March 2017.

That doesn’t sound very good. However, according to WorldACD, cargo yield (in US dollars) jumped 16.3% y-o-y, which does sound very good.

But neither the almost-flat demand, nor the great yield growth, is what it seems.

Start with yield. As WorldACD points out, yield growth is currency dependent, and the US dollar has devalued against many other currencies in the last year. Measured in Chinese yuan, cargo yields were up just 6.6% y-o-y in March. In euros, there was almost no yield growth at all – up just 0.8%. And remember, yield (revenue per kilo) is a top-line item, so, as WorldACD says, with jet fuel prices almost doubling in the last two years, “the recent large yield increase as measured in USD, may take on a different meaning for different parties.”

But just as the apparent strong growth in yield isn’t quite the good news it seems at first glance, so also the slowing growth is not the bad news it might seem. Start with the comparison month: IATA reported worldwide air freight traffic up 14.0% y-o-y in March 2017 – one of the strongest year-over-year gains ever. Also remember that the timing of the Chinese New Year holiday, and of the Easter holiday, had a negative impact on March air freight demand this year, and that, as IATA points out, the restocking cycle that had helped drive growth in the last eighteen months has ended.

Perhaps the best way to sum it all up is in the words of IATA: “We would caution against reading too much into these latest months’ data as yet.”

To which we would add that for the first quarter of 2018, worldwide air cargo traffic was up 5.4% over 1Q17, and that IATA, as well as many other analysts, forecast full-year 2018 air freight demand growth of 4% to 5%.

- With reports from ACW

.